AVS Chief Operating Officer Sean Gilligan [Photo courtesy of AVS]

After a career spanning almost three decades at Boston Scientific, Sean Gilligan’s new role at a startup has him working more closely with contract manufacturers and suppliers.

Gilligan is the chief operating officer at Amplitude Vascular Systems (AVS), which is developing a new intravascular lithotripsy system for treating severely calcified arterial disease.

He joined the Boston-based startup in March 2023 after a 29-year career at Boston Scientific. He started in 1994 as an engineer in Ireland and moved his way up to VP of program management and R&D, leading the portfolio for a large part of the interventional cardiovascular business.

“I had my fingers on a lot of different areas. I wasn’t in the weeds dealing with too many suppliers — we had a whole supplier engineering group [of] experts who had expert relationships with different suppliers,” Gilligan said in an interview with Medical Design & Outsourcing.

“It’s very different in a startup,” he continued. “I’m having to get very hands-on. It’s kind of intimidating and exciting at the same time, but I gravitate more to the hands-on stuff.”

Gilligan shared advice and tips for working with suppliers and other partners as private equity firms fuel consolidation in the contract manufacturing industry.

“That has helped some companies and hurt other companies and changed the DNA in some organizations,” he said. “It’s been a little bit more difficult than it might have been historically, only because of all those changes. Companies that might have had a reputation in particular area might not be as strong because of business changes and so on.”

But his approach to finding partners and building relationships remains the same, he said.

“In business, you’re never married, but you’re dating for a long time,” he said. “And both sides are doing the same thing. They have a goal to get married, but they never quite quite can get there.”

It starts with examining a potential partner’s capabilities and whether they can deliver what he needs to be successful. That includes whether they’re financially secure.

Gilligan says the big red flags he’s watching for right now are ongoing quality issues and high employee turnover, including at the highest levels.

“Just do your homework,” he said, later continuing, “Are there things that are going on — either from change at a management level or otherwise or funding — that are changing things behind the scenes? You’ve got to do a lot of digging outside the environment. Everybody tells you what you want to hear.”

Then it’s about opening up a bit — sharing business plans and what the road ahead looks like.

“Does that get them excited enough to not just get us the parts we need, but be bought in for the journey that we’re on?” Gilligan said. “If they are, that’s great, and if they’re not, that’s great, too. You’re trying to really drive a transparent relationship, getting to know people, getting to know the companies or the management to understand philosophically where are they going.”

If there’s a good fit, then comes the usual paperwork. But in addition to contractual agreements that protect both sides, it’s important to build in flexibility to give everyone room in case the unexpected happens.

While the supply chain is stronger than during the most challenging years of the COVID-19 pandemic, there are still shortages and lengthy lead times here and there.

“If something does go sideways, we’ll give them enough runway to help support their plans,” he said. “And in return, we need them to give us enough runway to support our plans. Because as we know, to change players in this regulatory environment, you can’t do it in five minutes.”

Supplier challenges as a startup

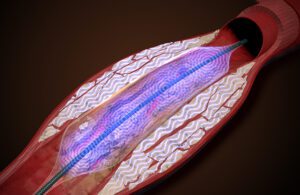

AVS designed its Pulse system to expand the artery while it breaks up the calcium to restore blood flow. [Illustration courtesy of AVS]

A startup like AVS is going to get less attention as a potential customer for contract manufacturers than a major OEM like Boston Scientific would. But suppliers that pick winners early on can benefit from the medtech industry’s sticky relationships.

“If you’re smart and get on board with the right companies, there’s a lot of room to grow on both sides. That’s just good management,” Gilligan said.

While suppliers can’t be expected to be deeply knowledgable about every space in medtech, their business development functions ought to be able to identify the high-growth, high-interest fields and find ways into them.

“There’s got to be some element of trust. We’ve got to lean forward, I’m not always gonna be able to call you [with a] two-month forecast, those types of things. We’re not at that stage. But if you’re on for the journey, look at what Shockwave’s done. No competition. Here’s what we’re trying to do. Do your research.”

Transparency, candor and passion go a long way, Gilligan said.

“I’m a big believer in being in the space, so people know where I come from. That gives me leverage,” he said. “And I’m fortunate in that they play a straight-up game, and I do the same thing.”

While it’s still too early to discuss the sales model with potential partners, AVS is far enough along that it’s not approaching contract manufacturers with an idea on the back of an envelope.

“When we tell our story and what we’re trying to do and ask people to go out and talk to physicians, people come back and say, ‘Yeah, we love you. We love your story.’ The market’s real, the clinical need is real, that global population keeps growing in terms of the number of people who need treatment over time. The reimbursement pathways are constantly evolving by virtue of what Shockwave has done. So this is purely about bringing a better product to market — and then working with whomever.”