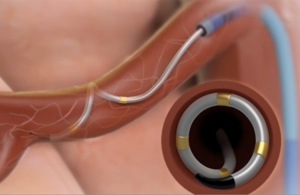

Medtronic’s Symplicity Spyral device is a multi-electrode radiofrequency catheter for renal denervation. [Image courtesy of Medtronic]

Medtronic’s Symplicity Spyral renal denervation (RDN) system for treating hypertension seems less likely now than ever to win FDA approval after yesterday’s vote Circulatory Systems Devices Panel vote.

The panel’s medical and statistical experts voted against recommending approval of Medtronic’s RDN therapy for hypertension under the proposed indications. While they supported approval of ReCor Medical’s competing RDN system one day earlier, a key difference was the failure of Medtronic’s RDN system to outperform hypertension drugs.

Medtronic acquired the technology through its takeover of Ardian in January 2011. Early clinical results were promising, but Medtronic announced in 2014 that its Symplicity HTN-3 trial failed to meet its primary endpoint.

Other companies abandoned their RDN efforts but Medtronic pressed on. And after yesterday’s vote, Medtronic officials said they aren’t done yet.

“We will continue to collaborate with the FDA on bringing a new option to the millions of people living with high blood pressure,” Medtronic SVP and Coronary and Renal Denervation President Jason Weidman said in a statement.

Related: What is renal denervation? Medtronic’s Jason Weidman explains

Medtronic’s share price slipped after the vote, while analysts who previously expected a favorable vote from the FDA review panel now say they think FDA approval is unlikely.

“Given [Medtronic’s] long and costly RDN program combined with multiple disappointments along the way … we expect {Medtronic] to abandon RDN if it fails to obtain an FDA approval this time around,” Needham analysts Mike Matson, David Saxon and Joseph Conway said in a note to investors today.

Baird Equity Research analyst David Rescott also said he believes the FDA will not likely approve the system. But if the FDA did approve it, “we would suspect a more restrictive label, thus potentially hindering reimbursement and physician/patient adoption,” he said in a note to investors.

Is there a way forward for Medtronic RDN technology?

The FDA review panel’s votes do not guarantee the FDA will decline to approve Medtronic’s RDN technology, but approval without the panel’s recommendation would be highly unusual. Most — if not all — recent examples of FDA approval without a review panel’s recommendation on risk/benefit have been in pharmaceuticals.

In 2011, the FDA’s Circulatory Systems Devices Panel took a look at the evidence backing a PMA for Champion’s CardioMEMS, now owned by Abbott. Those experts voted that the implantable blood pressure monitor did not prove effective and that the benefits did not outweigh the risks. The FDA issued a Not Approvable letter in 2012.

Champion continued to collect data to address the deficiencies listed by the FDA and in 2013 returned to the panel, which included the chair of this week’s review panel, Dr. Richard Lange. Again, the panel voted against its effectiveness, but this time said its benefits outweighed the risks. The vote against efficacy was due to confounding factors in the study that made it difficult to attribute positive outcomes to the device.

The catheter-delivered device won premarket approval (PMA) in 2014, making CardioMEMS the first FDA-approved implantable heart monitor. But even in that case, the FDA followed the panel’s recommendation on risk/benefit both times.

Device developers seeking FDA approval are allowed to amend pending PMAs with revisions or additional information. This can be done at the FDA’s request or on the applicant’s own initiative.

The review period may be extended by up to six months if an applicant submits a major amendment on their own initiative. The FDA defines a major amendment as one containing “significant new data from a previously unreported study, significant updated data from a previously reported study, detailed new analyses of previously submitted data, or significant required information previously omitted.”

An applicant could even withdraw its application entirely, or risk an FDA rejection — and either way, follow up with more studies if they want to take another shot.

FDA review panelist feedback for Medtronic

Medtronic’s Symplicity Spyral renal denervation system delivers radiofrequency energy to the nerves leading to the kidneys, which help regulate blood pressure. [Image courtesy of Medtronic]

Of Medtronic’s RDN system, FDA review panel members said they might have been able to support the risk/benefit question of the device if Medtronic was more specific in describing which patients would benefit. Medtronic’s proposed indication in its PMA submission is to reduce blood pressure in “patients with uncontrolled hypertension despite the use of anti-hypertensive medications or in patients in whom blood pressure lowering therapy is poorly tolerated.”

Dr. Matthew Corriere, professor of cardiovascular surgery at the University of Michigan, said that while he thought the clinical evidence supported the system’s safety and efficacy, he could not say whether the benefit justified the risk based on the patients for whom it would be indicated.

“We had some very broad criteria [and] we don’t know which patients are most likely to have a benefit that outweighs the risk. … More selective labeling in indications for the product and more severe instances of hypertension — not things like one drug for hypertension — would potentially tip that balance more in favor of the benefit outweighing the risk,” he said.

Dr. Robert Yeh, director of the Center for Outcomes Research in Cardiology at Boston’s Beth Israel Deaconess Medical Center, said he might have voted for the system’s effectiveness under a different indication, but that wouldn’t have changed his no vote on the risk and benefit.

“I would need additional randomized data to convince me that the benefits outweigh the risks,” he said.

Dr. Julia Lewis, professor of medicine in Vanderbilt University School of Medicine’s Division of Nephrology, said she was worried that physicians won’t be able to determine which patients RDN could help and which patients would be better off without.

“I think if it gets on the market, the anecdotal small sample size of each individual physician using this intervention will not allow them to select out the patients that will benefit from those who will benefit,” she said. “And to not have a definitive study that better defines that it is efficacious and in whom is actually a disservice to the public.”

Echoing those concerns was Dr. Patrick Nachman, director of the Division of Nephrology and Hypertension at the University of Minnesota. He said he’s convinced that RDN therapy can benefit some patients, but worries that subgroup is not defined and could be a minority of patients.

“For an invasive procedure — we may call it minimally invasive, but it is an invasive procedure — I worry about opening the gates, [doing] a lot of procedures to benefit only a minority of patients,” he said.

Medtronic has not yet said much about its next steps — such as a refined indication, new analysis of its data, or additional studies — beyond working with the FDA as the agency continues to review its PMA application.

At the end of yesterday’s meeting, Medtronic SVP and Chief Scientific, Medical, and Regulatory Officer Dr. Laura Mauri said the device developer would “[take into account all of the comments that we heard today.”

Related: Pay drops for Medtronic CEO and the median employee; bonus plan changes