The top medtech trends of 2023 included innovations such as artificial intelligence, new GLP-1 weight loss drugs and some long-awaited medtech finally receiving regulatory nods.

The top medtech trends of 2023 included innovations such as artificial intelligence, new GLP-1 weight loss drugs and some long-awaited medtech finally receiving regulatory nods.

With health providers facing additional challenges on top of an ever-uncertain economic environment, medtech companies also made major readjustments: layoffs, spinoffs, reorganizations and much more.

Here are the top stories that caught the attention of MassDevice readers and editors in 2023.

Top 2023 medtech trend No. 10: Questions about GLP-1 drugs

U.S. health providers wrote more than 9 million prescriptions in just three months for Wegovy, Ozempic and similar glucagon-like peptide-1 (GLP-1) weight loss drugs, according to analytics firm Trilliant Health. The popularity and initial effectiveness of the new drugs had medtech industry analysts asking a lot of questions about how the potential health benefits could reduce demand for devices. Medical device executives, however, were mostly unfazed about GLP-1s. Medtech companies such as Medtronic and Intuitive even argued that the drugs could increase the use of their technologies. Abbott presented data that suggested its FreeStyle Libre continuous glucose monitors were proving complementary to people taking GLP-1 drugs.

Read why Stryker executives think GLP-1 drug use could boost joint replacements.

Top 2023 medtech trend No. 9: Philips Respironics CPAP recall gets even more serious

Philips continued to slog through a recall involving millions of CPAP and BiPAP ventilators and other respiratory devices with sound abatement foam that could potentially break down and get into airways. By mid-year, FDA reported more than 100,000 reports potentially related to the problem, including 385 that mentioned deaths. Philips has agreed to pay at least $479 million to settle U.S. economic loss claims, but it still faces a host of lawsuits claiming injuries and deaths. Consent decree talks with the U.S. Justice Department continue. Most recently, the FDA warned of thermal issues with replacement CPAPs leading to burns and fires.

Here is our full timeline of the Philips recall.

Top 2023 medtech trend No. 8: A banner year for diabetes tech launches

Diabetes treatment tech saw a host of new product clearances and launches in 2023. Dexcom launched its next-generation G7 continuous glucose monitor, which is 60% smaller than its previous CGM. Tandem Diabetes Care won FDA clearance for its Tandem Mobi automated insulin delivery (AID) system. Other clearances included Beta Bionics’ iLet ACE automated insulin pump and iLet dosing decision software. And Medtronic Diabetes was back after overcoming a warning letter and other challenges, receiving FDA approval for its next-gen MiniMed 780G insulin pump system with the Guardian 4 sensor. On the M&A front, Medtronic nixed plans to spend $738 million on Korean insulin patch pump maker EOFlow, while Abbott closed on its buy of Bigfoot Biomedical and its Bigfoot Unity smart insulin management system.

Find out how reimbursement wins are fueling demand for Abbott’s next-gen FreeStyle Libre 3 CMG.

Top 2023 medtech trend No. 7: Surgical robotics shake-up

Medtech companies large and small sought to compete against Intuitive in the soft-tissue surgical robotics space. Despite the increased competition, Intuitive remains the undisputed leader. One competitor — Titan Medical — has mostly wound down., while Vicarious laid off workers around the beginning of 2023 and faces delisting from the New York Stock Exchange. Siemens Healthineers said it would discontinue the use of its Corindus surgical robotics for cardiology procedures. For its part, Johnson & Johnson is sticking with plans to develop its Ottava surgical robot. Also in 2023, Medtronic won the FDA’s permission to start its pivotal trial for Hugo robotic-assisted hernia procedures as it continued its Expand URO trial for prostatectomies.

Intuitive President Dave Rosa has advice on perseverance in surgical robotics.

Top 2023 medtech trend No. 6: The year of AI

Whether it’s OpenAI’s ChatGPT or Google’s Bard, generative artificial intelligence entered the popular consciousness in 2023. In medtech, it was hard to find a medical device company that wasn’t claiming that it was packaging some form of AI into its offerings. For example, Stryker officials see potential to use AI to better analyze health data to improve surgical robotics outcomes in orthopedics. Medtech companies could also use AI to improve manufacturing processes and optimize workflows for their health provider customers. However, industry insiders also caution that medtech needs to ensure that it’s using AI to solve real clinical problems rather than just implementing AI for its own sake.

Here are seven ways that AI could enhance healthcare.

Top 2023 medtech trend No. 5: Surprise medtech shutdowns

Some unexpected shutdowns in the medical device industry involved companies with technologies that boomed during the first years of the COVID-19 pandemic, but not so much after. For example, there was the abrupt shutdown of Avail Medsystems, which focused on building virtual connections between medical device sales reps and operating rooms. Overall, the fundraising environment remains tough for companies — and that is especially true for medtechs, with their lengthy timelines to develop products and get them to market. The good news, according to a recent Pitchbook report, is that dry powder remains high for a rebound of investments in the long term. Stay tuned on whether IPOs or even special purpose acquisition corporation (SPAC) deals eventually make a comeback.

Top 2023 medtech trend No. 4: Other medical device companies engage in some serious refocusing

Inflation, higher interest rates, supply chain challenges and more came together to make it more expensive to run a business in 2023. Medtech companies in particular have also had to grapple with their health provider customers working through operational challenges. Plus, China — a massive market — is centralizing buying for its healthcare system to reduce costs. The result was a great deal of refocusing, reorganizing and belt-tightening among many medical device companies. Industry giants Medtronic and Johnson & Johnson MedTech were among the companies announcing layoffs and restructuring in 2023. Big companies are engaging in spinoffs, too. For example, Medtronic and DaVita officially launched their Mozarc Medical kidney care spinoff. GE HealthCare officially became a stand-alone company at the start of 2023, and 3M Health Care is on the way to getting spun out of 3M as a new company called Solventum.

MassDevice has reported on more than 18,000 jobs cut in the industry since mid-2022.

Top 2023 medtech trend No. 3: Major medtech leadership changes

Medical device companies also saw a host of personnel and leadership changes over the past year. One of the most significant involved Ashley McEvoy, who announced she was stepping down as the worldwide chair of Johnson & Johnson MedTech. Tim Schmid, a 30-year J&J vet who was most recently company group chair of J&J MedTech Asia Pacific, has taken over the new role. Meanwhile, Bryan Hanson stepped down as CEO of Zimmer Biomet to lead the Solventum spinoff out of 3M.

Read our roundup of the biggest medtech personnel moves of 2023

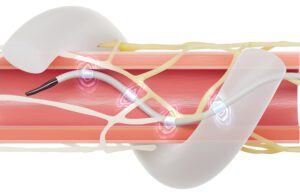

Top 2023 medtech trend No. 2: First pulsed field ablation system approval

Medtronic recently announced FDA approval of its PulseSelect pulsed field ablation (PFA) system, the first of its kind approved in the U.S. for the treatment of AFib. Competitor Boston Scientific expects approval of its Farapulse system in 2024, and keep an eye out for more PFA news from Medtronic on its Affera system that can toggle between pulsed field and RF ablation. (Johnson & Johnson’s Biosense Webster has a clinical trial underway for its own dual-energy ablation catheter.) Pulsed field ablation has generated a great deal of excitement in medtech because it is a nonthermal method for cardiac ablation to treat AFib. It delivers energy while reducing the risk of damage to surrounding structures.

What’s so special about pulsed field ablation? Medtronic SVP Sean Salmon explains

Top 2023 medtech trend No. 1: Renal denervation systems finally get cleared by the FDA

Nearly 13 years after buying Ardian and its hypertension-treating renal denervation (RDN) technology, Medtronic overcame a wide variety of clinical trial challenges to win FDA approval for its Symplicity Spyral RDN system. The November 2023 approval came soon after the FDA approved an RDN system developed by Recor Medical. Recor’s Paradise system uses ultrasound energy, while Medtronic’s Symplicity Spyral system uses radiofrequency energy. It could take time for companies to realize the full market potential of the technology. That hasn’t stopped Medtronic officials from considering additional uses, including the potential for Symplicity Spyral tech to help AFib patients when paired with cryoablation. And in the final weeks of 2023, another RDN competitor — Ablative Solutions — said its alcohol-mediated RDN pivotal trial hit its primary endpoint. Ablative Solutions CEO Kate Rumrill tells us to watch for more details in early 2024.