Medtronic SVP and President of Coronary and Renal Denervation Jason Weidman [Photo courtesy of Medtronic]

It took Medtronic nearly 13 years to win FDA approval for renal denervation (RDN) since buying Ardian and its hypertension-treating technology.

Jason Weidman, the Medtronic SVP who is also president of coronary and RDN, has a more personal measure of the long road to approval for the world’s largest medical device manufacturer.

“The first meeting that I had with the startup Ardien, my daughter was a newborn — and she started high school this year,” he said in an interview with Medical Design & Outsourcing.

This month, the FDA approved an RDN system developed by Recor Medical, and followed soon after with approval for Medtronic’s Symplicity Spyral RDN system. Both RDN systems treat hypertension by calming overactive nerves in the renal arteries with a minimally invasive ablation catheter procedure. Among other differences, Recor Medical’s Paradise system uses ultrasound energy, while Medtronic’s Symplicity Spyral system uses radiofrequency energy.

That decade-plus offered many lessons for Medtronic and other RDN developers, including some who bowed out after clinical trials failed to show efficacy. The following conversation has been lightly edited for space and clarity.

MDO: What lessons did Medtronic take away from its RDN efforts?

Weidman: The No. 1 lesson when you talk about a long journey like this is one of perseverance. It’s never a straight line path to bring a new technology to market, and in particular developing a new therapy. We went along that path, and there have been a lot of other really successful medical devices in history or pharmaceutical drugs in history that have had similar paths that have not exactly been straight, and we’ve had some bumps along the way. But here we are. We’re at a great spot and I couldn’t be more thrilled.

MDO: How do you keep up that perseverance? How do you keep yourself going, and how do you keep the team going?

Weidman: We always center ourselves on the patients. Medtronic is a very mission-driven company and I don’t think there’s any bigger mission than trying to help the world’s hypertension crisis. With over 1 billion people worldwide with hypertension, it’s the world’s largest contributor to death. Less than 20% of hypertensives across the globe are at target blood pressure. This is a huge problem and to go after this problem is super motivating. When you have an approach where the science behind it is sound and we knew that we could make a big difference, sometimes that’s all you need.

MDO: What did Medtronic learn about device design through its RDN efforts?

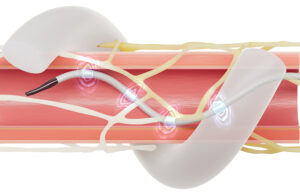

The Medtronic Symplicty Spyral renal denervation ablation catheter expands inside the renal arteries and ablates nerves in the vessel wall to treat hypertension. [Illustration courtesy of Medtronic]

Weidman: In 2014, our original pivotal trial, Hypertension 3 (HTN-3), used our original device design. While we were safe and while RDN lowered blood pressure, at that time we did not show a difference versus the control. And so we had to reassess our program and reassess our device design. Speaking specifically about device design, one of the things that we learned — which is typical for medical devices — is you want to make procedures as easy and repeatable as possible while still achieving your clinical objectives. So we changed our device design at that time from one where you had a single application of the therapy with a single-point device to one with multiple points of therapy application with one press of the button, so to speak. And so we just made the system more repeatable and easier to use. That was really helpful for us going forward.

MDO: You’re talking about the four electrodes rather than one, correct?

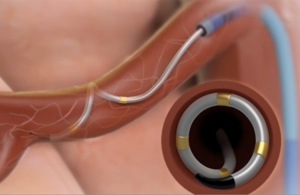

Medtronic’s Symplicity Spyral catheter has four electrodes that deliver radiofrequency energy to overactive nerves that help regulate blood pressure. [Image courtesy of Medtronic]

Weidman: We went from one electrode to this spiral pattern where we have four placed as 12, 3, 6 and 9 o’clock so you get that spacing all around that vessel to give you the maximium chance at getting effective ablation. What’s also super important about the spiral device is that it’s a one-size-fits-most device to treat virtually all patients. We don’t have multiple-size devices. We have one device that treats most patients’ vessel sizes from 3 mm to 8 mm. It’s a nitinol-based device that allows it to expand in that spiral pattern and almost fill the diameter of the vessel. In our clinical trials, we only had about 3% of patients fall out for anatomical exclusions, and that’s much different than other devices and other trials. For instance, if you look at the Recor trials, they excluded about 26% of patients due to anatomical reasons.

MDO: What other clinical and regulatory lessons did Medtronic take away from its RDN efforts?

Weidman: We learned a lot about the procedure, how to run those trials and the difficulty of doing trials where patients are on hypertensive medications because it’s hard to control patient behavior. With the procedure, we learned after HTN-3 — there’s been countless preclinical studies and cadaver studies — that to maximize your chances at effective ablation you need to go into the branch arteries of the kidneys. That’s what the science will tell you. And so we changed where we went with our device and ablated not only the main arteries, but we started to go into the branches. And we really think that’s going to be critically important to get strong, sustained long-term results, which we see with our catheter. From a clinical trial perspective, the big thing we learned is how we do our best to control what’s going on with the patients so that they’re not changing their medications — which can obviously impact the results — or if they are, we know what’s going on. In our latest series of trials, we do blood and urine testing of the patients so we know exactly what is in their system. Patients will tell you that they’re taking their medications or they’re not changing their medications, but that’s not always the case, and we can actually see that in these latest versions of our trials because of those tests.

MDO: Are there any other insights you’d like to share that might be helpful for other device developers?

Weidman: While randomized, sham-controlled studies had been done in the medical device space in the past, they really came into being with RDN. I believe that there are more or nearly as many sham-controlled studies in the RDN field as there are in the rest of medical devices combined. It’s a new bar, but when embarking on these types of studies, you have to be very careful and precise in your clinical trial design and be very clear in doing what you can to make sure patient behavior is consistent between your control arm and your treatment arms.

MDO: Approval seemed questionable after this summer’s FDA review panel votes. How did Medtronic overcome that challenge?

Weidman: We were always really hopeful. One of the real strengths of our program and one of the good parts about being on a long journey is we have a lot of positive clinical data. It’s not very often you see a brand-new device come in front of the FDA for approval that has over 4,000 patients in clinical trials across five different studies and 2,000 patients out to three years. It’s kind of difficult to get to the nuances of all of that data and the breadth of all of that data in a single-day panel with a lot of panelists that haven’t really spent much time on RDN before. We have the benefit of working with FDA over a long period of time and we were pretty confident that FDA had a good understanding of the totality of the data and really appreciated the benefits that this therapy could bring.

MDO: What were conversations with the FDA like in the months before approval, and what were the key points of focus?

Weidman: The conversations over the last couple of months were really a continuation of conversations from the past year or even many years. The process with FDA has been collaborative for a long time. We’ve worked with them throughout to make sure we were providing what they wanted to see. But at the end of the process, as with the end of any process for a new therapy, you’re zeroing in on things like indication, postmarket studies, final labeling tweaks and things like that.

MDO: Any last thoughts to share?

Weidman: There’s a tremendous unmet need with patients. And it’s not just that you have less than 20% of hypertensives with their blood pressure uncontrolled, but it’s that these patients really want other options. Studies run in countries across the globe to understand a patient’s interest and willingness to have a procedure to treat their blood pressure consistently show a pretty large percentage of patients are looking for something like this. We’re in a great spot to help a lot of patients and we’re going to fill a void that’s desperately needed for this global epidemic of hypertension.

Read more from this interview at MassDevice, including Medtronic’s plans for commercialization, manufacturing and postmarket study.