[Lab image by Michal Jarmoluk from Pixabay]

The past year has been an unprecedented time for the pharmaceutical industry.

On the one hand, the pandemic resulted in substantial delays to clinical trials while also forcing sponsors to rethink clinical trial design to protect participants. But on the other hand, the pandemic underscored the importance of the pharma industry in society.

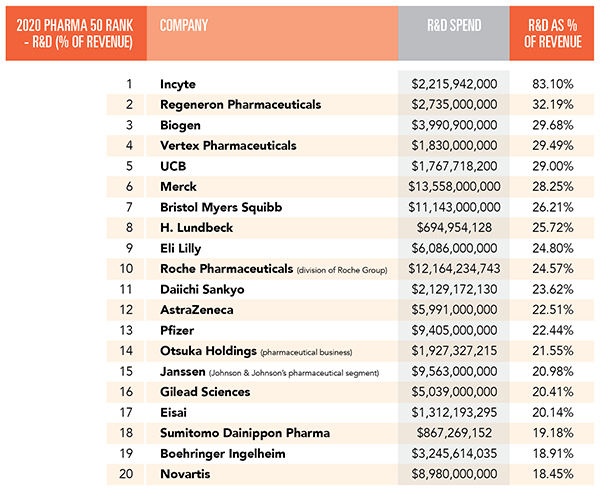

While the pandemic certainly was a driver for substantial R&D spending in the industry in 2020, a significant expense for many companies last year was licensing fees and other acquisition costs. That trend is not just apparent for Incyte, which tops this list, but also for several other companies in this ranking of 20 firms, which are ranked below based on the percent of revenue they invest in R&D. (To find out the top 50 pharma companies, check out our recently published ranking here.)

Top R&D spenders ranked by spending as a percent of revenue.

1. Incyte

Last year, Incyte‘s R&D expenses jumped to $2.216 billion. In 2019, they were from $1.154 billion. But the increase was primarily a result of an increase in clinical research and outside services. In 2019, the company spent $677 million on those items. Last year, the total increased to $1.701 billion.

The chief reason behind the jump is a result of an $804.5 million payment to MorphoSys. The two companies have entered into a global collaboration and license agreement for tafasitamab, a monoclonal antibody targeting the antigen CD19. The two companies plan to commercialize tafasitamab in the U.S., with Incyte retaining exclusive commercialization rights outside of the U.S.

Another substantial R&D expense was Incyte’s purchase of an FDA priority review voucher for $120 million. It plans to use the voucher in conjunction with a submission for ruxolitinib cream to treat atopic dermatitis.

Incyte also logged a $40 million charge related to a collaboration and licensing deal with MacroGenics.

The company was involved in the development of Tabrecta, a targeted treatment for patients with metastatic non-small cell lung cancer that have a mutation leading to MET exon 14 skipping. Licensed to Novartis (NYSE: NVS) by Incyte (NSDQ:INCY), Tabrecta has won Breakthrough Therapy Designation from FDA.

Out of the company’s 1,773 employees, approximately 930 of them work in R&D.

2. Regeneron Pharmaceuticals

Last year, Regeneron scored emergency use authorization for its COVID-19-targeting monoclonal antibody cocktail (casirivimab/imdevimab). The REGEN-COV cocktail appears to be more effective against emerging SARS-CoV-2 variants than Lilly’s combination of bamlanivimab/etesevimab. The REGEN-COV antibody cocktail has been a driver of increased R&D spending, which jumped 28% year-over-year in the first quarter of 2021. Regeneron is working with Sanofi to win new regulatory approvals for the blockbuster eczema drug Dupixent into five new disease areas, including chronic obstructive pulmonary disease, eosinophilic esophagitis, prurigo nodularis, chronic spontaneous urticaria and bullous pemphigoid. In 2020, Science magazine ranked Regeneron as the top biopharma company to work for. The magazine has ranked the company in slot number one or two for the past 10 years.

3. Biogen

Biogen‘s R&D budget jumped $1.7 billion, or 75.0%, to nearly $4 billion in 2020. The chief driver of the spending increase was a $1.9 billion charge related to upfront payments tied to collaborations with Sangamo, Denali and Sage.

Core R&D focus areas for the company include multiple sclerosis (MS)/neuro-immunology, Alzheimer’s disease, neuromuscular disorders, movement disorders, ophthalmology and neuro-psychiatry.

In March 2020, the company acquired a novel CNS-penetrant small molecule inhibitor of casein kinase 1, known as BIIB118, from Pfizer. BIIB118 is a potential treatment for a variety of behavioral and neurological symptoms. Biogen is working on developing the drug candidate to treat irregular sleep-wake rhythm disorder in Parkinson’s patients. Biogen also plans to develop BIIB118 as a possible treatment of sundowning (late-day confusion) in Alzheimer’s disease.

The company is currently seeking FDA approval for the Alzheimer’s drug candidate aducanumab, which it is jointly developing with Eisai (#17 on this list).

4. Vertex Pharmaceuticals

Roughly three out of every five employees at Vertex Pharmaceuticals work in R&D.

Prominent pipeline drugs for the company include a candidate to treat alpha-1 antitrypsin (AAT) deficiency, a genetic condition that leads to an elevated risk for lung and liver disease. The company has an ongoing Phase 2 proof-of-concept trial for a compound known as VX-864, an investigational small molecule corrector for AAT deficiency.

Other focuses for the company’s small-molecule program include kidney diseases tied to apolipoprotein L1 (APOL1). Last year, the company launched a Phase 2 clinical study in this area using an experimental drug known as VX-147.

The company is also experimenting with drugs that inhibit the sodium ion channel subtype known as NaV1.8. Vertex believes such inhibitors could be an alternative to opioids for pain relief.

Vertex Pharmaceuticals’ cell and genetic therapies include programs for treating sickle cell disease, transfusion-dependent beta-thalassemia, type 1 diabetes, Duchenne muscular dystrophy and myotonic dystrophy type 1.

5. UCB

The Belgian multinational biopharma company boosted its R&D spending by 23% in 2020 to €1.569 billion ($1.896 billion in USD) . Included in that sum are R&D costs related to UCB’s 2020 acquisition of Ra Pharmaceuticals, Engage Therapeutics and Handl Therapeutics. The Handl buyout bolstered UCB’s gene therapy program.

The acquisition of Ra Pharmaceuticals added investigational treatment for myasthenia gravis (MG), known as zilucoplan, to its pipeline.

In all, however, UCB’s R&D expenses were slightly lower in 2020 than the preceding year, owing to the cost of increased pandemic-related safety protocols for clinical trials.

UCB also acquired a new campus in Surrey, U.K., to support discovery and development and early manufacturing activities of pharmaceuticals.

6. Merck

Merck’s 2020 R&D costs were $13.6 billion, increasing by 37% over 2019. In raw numbers, the company spent more on R&D than any of the other 19 here. (See the ranking below.) The main reasons for its 2020 R&D spending increase were payments associated with acquisitions and collaborations. Chief among those charges was a $2.7 billion expense related to its purchase of VelosBio, a clinical-stage biopharmaceutical company. The company’s R&D division focusing on human health spent $6.6 billion in 2020 compared with $6.1 billion in the prior year. The company also logs animal health research expenses and licensing fees as R&D expenses.

Expenses also increased for clinical development and investment in discovery and early drug development. Merck also incurred higher restructuring costs ($83 million) in 2020 than in the prior year. Still, the pandemic also led to some cost savings on clinical trials.

7. Bristol Myers Squibb

Bristol Myers Squibb’s drug discovery and development activities are spread throughout the world. In addition to operating multiple research facilities in the U.S., the company has drug discovery and development facilities in India, Belgium, the U.K., France, Spain and Japan. At present, the company has more than 50 compounds in development in more than 40 disease areas. The company aims to boost sales for its immuno-oncology treatment Opdivo by expanding the number of indications for the drug. Opdivo clinical studies are underway testing the drug as a monotherapy or combination therapy for various tumor types. In 2019, the company managed to secure FDA approval for its multiple sclerosis drug Zeposia and Rebozyl for myelodysplastic syndromes. BMS’s $13.1 billion acquisition of MyoKardia gave the company access to mavacamten, which could be a novel cardiovascular medicine to treat obstructive hypertrophic cardiomyopathy. The company also plans to test the potential of mavacamten for other conditions. Other drug candidates in MyoKardia’s pipeline are the selective cardiac myosin activator danicamtiv and MYK-224, a small-molecule cardiac myosin inhibitor.

8. H. Lundbeck

Focused on providing drugs to meet unmet medical needs in specialist neuroscience indications, H. Lundbeck saw its R&D costs increase 46% in 2020 to DKK 4.545 billion ($695 million). In all, the company invested more than one-quarter of its budget on R&D. When excluding impairment and restructuring costs, the R&D ratio was 21%. In H. Lundbeck’s most recent annual report, the company explained that it intends to transform its approach to R&D to “enable delivery of a steady stream of breakthrough and differentiated medicines across all phases of the pipeline.” In its early clinical pipeline, the company launched Phase 1 trials for two new molecules to replace two that exited Phase 2 trials. H. Lundbeck also continues to launch trials to support label expansion for drugs that are already on the market. Like many other pharma companies, the pace of clinical development decreased in the early months of the pandemic. Still, enrollment rates for many of its trials are now increasing.

9. Eli Lilly

Eli Lilly boasts that it has focused on R&D for more than 140 years. Investing nearly one-quarter of its budget in R&D, the company employs roughly 7,600 people in drug discovery and development positions. In the U.S., it has R&D sites in San Diego and San Francisco in California and New York City. It also operates R&D facilities in Spain and Singapore. Key focus areas include diabetes, oncology, immunology, neurodegeneration and pain management. Last year, the company also ramped up its focus on COVID-19 and scored emergency use authorization (EUA) for the antibody treatment bamlanivimab (LY-CoV555) as a monotherapy. The company has since won EUA for bamlanivimab paired with another monoclonal antibody, etesevimab.

10. Roche Pharmaceuticals

The stakes are high for the Swiss pharma giant Roche. The company may spend approximately one-quarter of its revenue on R&D, but its current portfolio of drugs is under assault. Its prominent cancer drugs Herceptin, Avastin and Rituxan, are now facing biosimilar competition that resulted in CHF 5.7 billion ($5.4 billion) in price erosion in 2020. Prominent members of Roche’s pipeline include faricimab, a potential treatment for diabetic macular edema and neovascular age-related macular degeneration. Roche announced in February that the Phase 3 study suggests physicians could administer the investigational injectable eye medicine at dose intervals of up to four months in the first year of treatment. Roche also has Phase 3 trials underway evaluating gantenerumab, a beta-amyloid antibody proposed as an Alzheimer’s disease treatment. The drug candidate has failed to halt disease progression in earlier studies. In 2020, Roche also paid $120 million to UCB for rights to that company’s anti-tau antibody candidate for Alzheimer’s disease.

11. Daiichi Sankyo

Since it was founded in 2005, Daiichi Sankyo has prioritized drug discovery. The company has been involved in developing drugs such as the statin pravastatin, the antibiotic levofloxacin, the antihypertensive drug olmesartan and the anticoagulant edoxaban. The company’s current R&D efforts focus on emerging antibody-drug conjugates, nucleic acid drugs, gene therapy, cell therapy, lipid nanoparticle mRNA and glycoengineering technology. One prominent drug in the company’s pipeline is DS-8201, which it is jointly developing with AstraZeneca. FDA granted priority review to DS-8201 for HER2-positive metastatic breast cancer. In terms of its COVID-19 response, Daiichi Sankyo is exploring the repositioning of drugs in its current portfolio and pipeline. In 2020, the company aimed to improve its manufacturing and R&D operations efficiency, divested two locations and closed five others.

12. AstraZeneca

AstraZeneca’s most notable R&D project in 2020 was the development of its Vaxzevria COVID-19 vaccine (ChAdOx1-S). The company’s core R&D areas include oncology; cardiovascular, renal and metabolism; respiratory and immunology; neuroscience and microbial science. The company has two R&D teams. One specializes in oncology, while a biopharmaceuticals R&D unit focused on the remaining focus areas. In 2020, AstraZeneca ramped up its investments in digital technology related to R&D. Those investments are primarily intended to support clinical trials. In December 2020, AstraZeneca announced its intent to acquire Alexion Pharmaceuticals. If the acquisition is successful, it will boost AstraZeneca’s pipeline in immunology.

13. Pfizer

Pfizer has been aiming to reinvent itself for nearly a decade. Still, its transformation in 2020 shifted into high gear as the company developed one of the most effective COVID-19 vaccines with its partner BioNTech while also shedding its Upjohn division to redouble its focus on innovation.

The company’s R&D expenses in 2020 grew by $1 billion due to costs linked to its BioNTech partnership and payments to the biopharma Myovant Sciences and infectious disease specialist Valneva.

As of May 4, 2021, Pfizer has 100 drugs in its pipeline. It has 22 candidates in Phase 3 trials and 10 at the registration stage, including the BNT162b2 COVID-19 vaccine.

Pfizer also plans to explore the use of mRNA for a range of conditions, including cancer and genetic disease.

Pfizer is also working with Myovant Sciences to commercialize the gonadotropin-releasing hormone antagonist medication relugolix to treat uterine fibroids, endometriosis and advanced prostate cancer.

14. Otsuka Holdings

Otsuka’s R&D expenses in 2020 were ¥216,841 million (approximately $2 billion), which was up 0.5% over the prior year. The slight increase was partially due to development expenses tied to the psychiatric drugs Rexulti and the monoclonal antibody VIS649.

In 2020, the company scored regulatory approval in Japan for aripiprazole while also applying in that country for fremanezumab to prevent migraines.

In oncology, the company launched a Phase 3 trial for Inqovi (decitabine, cedazuridine) to treat acute myeloid leukemia. In the U.S., the company won FDA approval for the drug cocktail to treat myelodysplastic syndrome and chronic myelomonocytic leukemia. It also launched a Phase 3 trial in Japan for TAS-118 to treat osteosarcoma.

15. Janssen

Johnson & Johnson’s pharmaceutical subsidiary spent just under 21% of its revenue on research and development last year, or $9.56 billion. The company boasts that its R&D investments are more than double what it spends on marketing and sales. Its R&D spending has increased by an average of 8.1% over the past five years.

The company’s $42.2 billion investment in R&D from 2016 to 2020 has yield four new FDA-approved prescription medicines and 42 additional approvals for expanded indications or new product formulations.

Thanks to Johnson & Johnson’s acquisition of Momenta in October 2020, the company has sharpened its focus on autoimmune diseases. The company now has rights to nipocalimab (M281), a clinically validated antibody. Nipocalimab could treat autoimmune diseases and unmet medical needs in rheumatology, dermatology, autoimmune hematology, maternal-fetal disorders and neuro-inflammatory disorders.

16. Gilead Sciences

Gilead Science’s R&D division focuses on potential treatments for HIV/AIDS, liver diseases, hematology and oncology, inflammatory and respiratory conditions, and cardiovascular disease. While HIV remains a significant focus, the company received substantial attention in 2020 for its broad-spectrum antiviral medication known as Veklury (remdesivir), which scored FDA approval for hospitalized COVID-19 patients 12 and older who weigh at least 40 kg. The company is looking to expand the indication to include outpatients. Also in 2020, Gilead acquired Immunomedics for approximately $21 billion, adding the oncology drug Trodelvy to its pipeline. Trodelvy won FDA approval in April 2021 for the treatment of metastatic triple-negative breast cancer. The drug is the first demonstrated to improve progression-free survival and overall survival for metastatic triple-negative breast cancer. FDA also granted accelerated approval to Trodelvy for the treatment of metastatic urothelial cancer. The company is also evaluating HIV capsid inhibitor Lenacapavir as part of a long-acting regimen for heavily treatment-experienced people with HIV. The drug won breakthrough therapy designation from FDA for this indication. Gilead is also evaluating the antiviral to treat chronic hepatitis delta virus (HDV) infection. Lenacapavir has won orphan drug and breakthrough therapy designations from FDA for chronic HDV infection.

17. Eisai

Even though the company invested heavily in BAN2401 for early Alzheimer’s disease, Eisai’s R&D costs fell in 2020 thanks to savings from research alliances. The company signed a collaboration agreement with Biogen related to BAN2401 in 2014 to develop the therapeutic antibody. It also has a partnership with Merck to test the potential of the tyrosine kinase inhibitor Lenvima (lenvatinib) as a combination therapy with Merck’s blockbuster anti-PD-1 antibody Keytruda. Eisai is also researching the anti-tau antibody E2814 as a potential Alzheimer’s treatment. The antibody was discovered as part of a research collaboration between Eisai and the University College London. Eisai also established the Eisai Center for Genetics Guided Dementia Discovery (G2D2) in Cambridge, Mass., in 2019. That center focuses on targeting cells in the nervous system known as microglia involved in neural inflammation.

18. Sumitomo Dainippon Pharma

With roots stretching back to 1885, the Japanese company is now focused on unmet needs in psychiatry, neurology, oncology, regenerative medicine and cell therapy. The company acknowledges that its focus on psychiatry, neurology and oncology results in a high degree of R&D uncertainty. In 2020, its Sunovion subsidiary scored an FDA approval for the use of Kynmobi (apomorphine HCl) to treat “off” episodes of Parkinson’s. Such episodes occur after levodopa (still the most commonly prescribed drug for neurodegenerative disease) stops positively affecting Parkinson’s symptoms. In addition, Myovant Sciences, which has received funding from Sumitomo Dainippon Pharma, won FDA approval in December for the first oral gonadotropin-releasing hormone receptor antagonist, relugolix, for patients with advanced prostate cancer. Prominent psychiatric/neurology drugs in Sumitomo Dainippon Pharma’s pipeline include SEP-363856 for schizophrenia and SEP-4199 for bipolar depression. SEP-363856 is currently in a Phase 3 trial in the U.S. and a Phase 1 trial in Japan. SEP-4199 is in a Phase 2 trial in the U.S. and Japan. Rounding out the company’s pipeline are the oncology drugs napabucasin and alvocidib. The former has shown promise in clinical trials for colorectal cancer, gastric cancer, pancreatic cancer and non-small cell lung cancer. Clinical trial data suggest alvocidib has the potential to treat several types of cancer.

19. Boehringer Ingelheim

R&D spending has long been a priority for Boehringer Ingelheim, and its research and development spending grew last year. Also in 2020, Boehringer Ingelheim boasted that its Corona Accelerated R&D in Europe (CARE) initiative was the largest undertaking on the Continent focused on developing COVID-19 therapies. Boehringer also formed the COVID-19 Therapeutics Accelerator in March 2020 with support from Mastercard, the Wellcome Trust and the Bill & Melinda Gates Foundation. The company itself has had a strong focus on developing antibodies to neutralize the SARS-CoV-2 virus. In December 2020, the company also began a research collaboration with Cologne University Hospital, the University of Marburg and the German Center for Infection Research (DZIF) to explore the potential of BI 767551, a novel SARS-CoV-2 neutralizing antibody. In general, the company has recently ramped up its focus on partnership and research alliances. Outside of COVID-19, a key research focus for the company is developing drugs targeting the Kirsten RAt Sarcoma (KRAS) viral oncogene. An oncogene is a gene that can potentially cause cancer.

20. Novartis

In 2020, core R&D expenses as a percentage of net sales decreased by 0.9%, but its R&D in its Sandoz segment increased by 0.5%. Sandoz has made considerable investments in its biosimilar pipeline. In its annual report, Novartis notes that the development of biosimilars is generally significantly less expensive than the development of originator pharmaceuticals. But biosimilars are more costly to develop than many small-molecule generic products. In 2020, Novartis’s R&D division scored a regulatory win by convincing the FDA to expand the indication of Entresto (sacubitril/valsartan) for heart failure patients with preserved ejection fraction. In addition, the company has announced positive results in a Phase 3 trial involving radioligand therapy 177Lu-PSMA-617 in patients with advanced prostate cancer. Novartis also entered into a deal with BeiGene to co-develop tislelizumab, an anti-PD-1 monoclonal antibody. The companies have announced positive Phase 3 results for tislelizumab for treating esophageal and non-small cell lung cancers. In addition, Novartis won orphan drug designation from the European Medicines Agency for the oral, small-molecule drug iptacopan (LNP023) to treat immunoglobulin A (IgA) nephropathy. A Phase 2B trial involving Iptacopan for IgA nephropathy met its primary endpoint, clearing the way for a Phase 3 study.