[Adobe Stock]

Despite challenging interest rates and regulatory environment, pharma M&A activity surged in 2023 with deal volume up more than 30% from the prior year based on a review of more than 200 acquisitions since 2018. The total disclosed deal value in 2023 also more than doubled the prior year’s tally to surpass $100 billion. While the pandemic boosted research into areas such as mRNA, it had something of a chilling effect on M&A. As pharma companies begin to put the pandemic in the rearview mirror, M&A activity has gained momentum.

Analysts upbeat on biopharma M&A activity in 2024

According to PwC, the M&A activity in the pharmaceutical and life sciences sector could continue humming in 2024. Despite a challenging interest rate environment, PwC projects the sector to see deal values ranging from $225 billion to $275 billion. Deal volume in 2023 was in line with pre-pandemic levels.

Leerink also expects biopharma M&A to stay elevated in 2024 as companies continue eyeing mergers, reverse mergers, and cash-out deals. The firm concluded that oncology was the top therapeutic area by deal value in 2023 with $49B across 11 deals. Rare disease and immunology rounded out the number two and three slots, respectively, by value. Leerink also noted that while overall healthcare M&A deal value dropped 10% and volume declined 34% between 2022 and 2023, biopharma remained the most active subsector, representing 58% of total deal value in 2023.

Big Pharma goes on a buying spree

In 2023, Big Pharmas emerged as especially hungry buyers, a reversal of the prior trend of strong buying activity from aggressive mid-sized firms. In 2023, companies such as Bristol Myers Squibb, AstraZeneca and AbbVie inked multiple billion-dollar plus deals spanning hot areas like oncology and gene therapy. The biggest deals by size included Pfizer’s $43 billion acquisition of Seagen, Amgen’s pending $27.8 billion acquisition of Horizon Therapeutics, Bristol Myers Squibb’s $14 billion acquisition of Karuna Therapeutics and AbbVie’s $10.1 billion buyout of Immunogen.

A diverse set of buyers in 2023

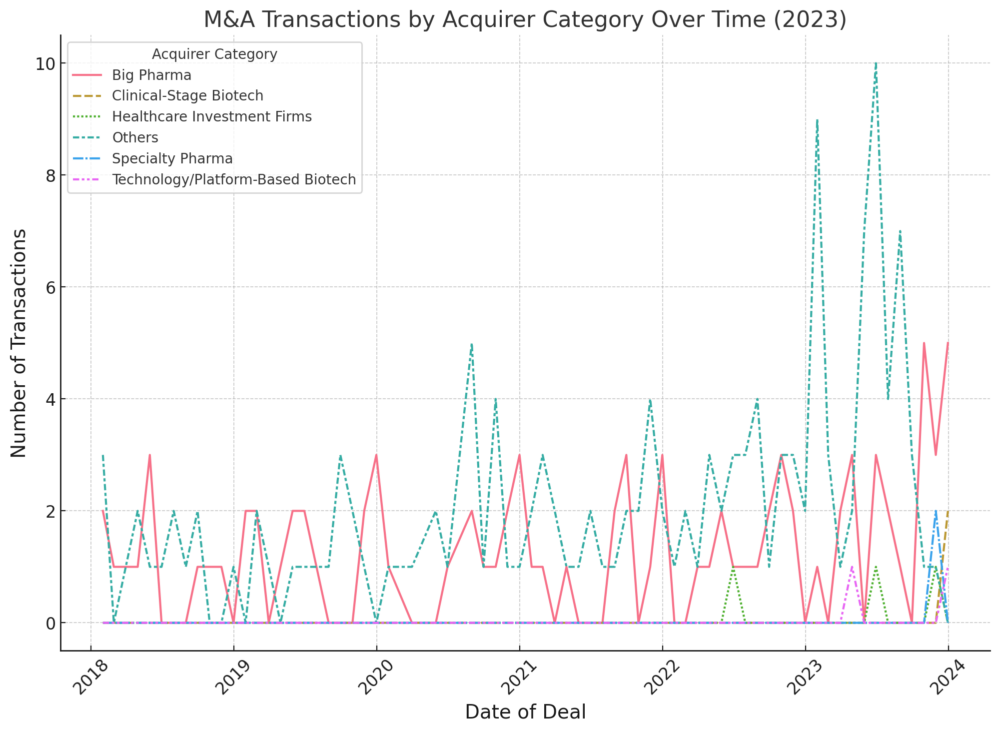

Overall, 2023 saw the emergence of a wider mix of buyers, which included players such as Biogen and Moderna, while private equity and royalty-based buyers like Gurnet Point Capital boosted participation. When focusing on acquirers, a relatively sporadic dataset emerges, but clinical-stage biotechs such as Purple Biotech have emerged as more frequent players. In terms of deal size, however, such players tend to target relatively small acquisitions. Examples include Leap Therapeutics purchasing Flame Biosciences for $86 million in January 2023, Purple Biotech acquiring Immunorizon for $100 million in February, and Pyxis Oncology scooping up Apexigen for $16 million in May 2023.

Big Pharma consistently acquires, while clinical-stage biotech peaked in 2023.

In 2023, healthcare investment firms also carved out a more influential role, as mentioned earlier. Firms such as OrbiMed, Deerfield Management, and Gurnet Point Capital all made strategic acquisitions. OrbiMed participated in deals such as the acquisition of Embark Biotech in August for $16 million. Deerfield Management was also active, taking part in transactions like the buyout of Alfasigma’s stake in Intercept Pharmaceuticals for approximately $794 million in September. According to Crunchbase, OrbiMed made 20 investments in various healthcare and biotech companies in 2023, demonstrating the firm’s active participation in the sector.

Meanwhile, Gurnet Point Capital expanded its portfolio through investments such as the acquisition of Paratek Pharmaceuticals in June for $123 million. The figure below highlights the growing role of healthcare investment firms as well as the enduring and commanding presence of Big Pharma in the M&A landscape.

M&A transaction over time (not exhaustive). Raw source data in .csv format available here.