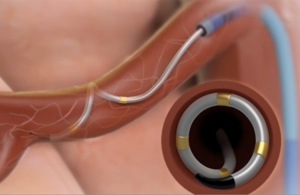

The Symplicity Spyral renal denervation system delivers energy to the nerves leading to the kidneys, which help regulate blood pressure. [Image courtesy of Medtronic]

The Medtronic (NYSE:MDT) Symplicity Spyral renal denervation (RDN) treatment’s failure to outperform hypertension drugs came as unexpected news to analysts who have been watching the industry’s efforts in the space for years.

Analysts from BTIG and Truist Securities said they have new questions about commercialization, reimbursement and physician acceptance as Medtronic seeks FDA approval for what could be a billion-dollar business.

While the Symplicity Spyral treatment for patients on blood pressure medication was demonstrated to be safe and showed a statistically significant and clinically meaningful reduction in office-based systolic blood pressure, the treatment failed to meet its primary efficacy endpoint.

“The surprising update was that the trial did not show statistical significance in 24-hour ambulatory systolic blood pressure (ABPM) as the sham control group showed an unexpected drop in BP largely due to medication changes favoring BP reductions,” BTIG analysts Ryan Zimmerman and Sam Durno said in a note to clients. “While this was surprising, we think MDT explained the nuances within the sham control group and these results do not take away from the abundance of clinical data MDT has built around its RDN program. Despite multiple trials not showing statistical significance (HTN-3 and ON MED) we think that RDN has still proven to be safe and effective and serves as an alternative to medication management in a multi-billion dollar market opportunity.”

RELATED: What is renal denervation? Medtronic Coronary and RDN President Jason Weidman explains

At Truist, analysts Richard Newitter, David Rescott, Samuel Brodovsky and Lin Zhang said the “disappointing” missed endpoint isn’t a fatal blow for RDN, “but it does likely mean a heavier lift to develop the market, attain reimbursement, and drive broad-based physician acceptance — of course assuming FDA approval is granted.”

Why Medtronic’s Symplicity Spyral trial missed its primary endpoint

Medtronic offered an investor update on the latest RDN results and said the Symplicity Spyral trial failed to significantly outperform the sham control group due to the pandemic and medication changes for patients enrolled in the study.

“MDT attributed missing the primary efficacy endpoint to significant differences in baseline 24-hour ABPM patterns between pre- and during-COVID populations and a larger drop in BP in the expansion cohort due to unbalanced medication changes,” the BTIG analysts said. “MDT highlighted that 80% of the expansion cohort follow-up occurred during the COVID pandemic.”

Medtronic said patients in the expansion cohort dramatically changed medication intake, with a higher proportion of sham patients increasing their medication intake while a higher proportion of patients who received the RDN treatment decreased their medication intake.

Commercialization and reimbursement of Medtronic’s Symplicity Spyral RDN treatment

The BTIG analysts said they were satisfied with Medtronic’s explanation of why the trial missed that primary endpoint, but they’re still not clear on commercialization and reimbursement for Symplicity Spyral, assuming FDA approval.

Medtronic executives charted three possible routes to reimbursement in the U.S.:

- A national coverage decision

- Working with each of the seven Medicare Administrative Contractors (MACs)

- Reimbursement for innovative technology by the Centers for Medicare & Medicaid Services (CMS) under the potential Transitional Coverage for Emerging Technologies (TCET) program.

“For private payers, reimbursement will likely be established on a payer-by-payer basis but we think that this will prove more challenging given the missed statistical endpoints and may require post-market data,” the BTIG analysts said.

What’s next on FDA approval and the market for RDN?

Medtronic said it filed the latest results as the final module in its Symplicity Spyral Premarket Approval package to the FDA for review and approval. The company is preparing to take the radiofrequency catheter technology to a FDA panel if necessary, BTIG analysts said, with an update expected in the first three months of 2023.

Approval could come as early as 2024, the Truist analysts said, but an FDA panel could delay that approval by another year.

“In addition to the consistent absolute blood pressure drops that we have demonstrated across trials, long-term data from key Medtronic studies — which were highlighted in two important publications this year in The Lancet — have also demonstrated the durability and ‘always on’ effect of RDN,” Medtronic SVP and Coronary and Renal Denervation President Jason Weidman said in a news release. “The ON MED results presented today serve as an additional piece of our extensive compendium of safety and efficacy evidence on this procedure. With these results in hand, we submitted our PMA package to the FDA, which includes the totality of available evidence from the SPYRAL HTN clinical program. We are excited about the potential to bring this important procedure to millions of U.S. patients in need.”

How big is Medtronic’s RDN market opportunity?

Medtronic leaders also expressed confidence that a 1% market penetration would equal a $1 billion business opportunity. They previously estimated global market revenue of at least $500 million by 2026 and $2-3 billion by 2030, but did not reaffirm those targets after the latest results.

“The lack of statistical significance makes the trajectory and ultimate magnitude of any revenue contribution uncertain,” the Truist analysts said.

Medtronic has at least four RDN pipeline projects — Pulsar, G4, Helyx and GOAT — with technology updates including new interventions and energy sources.

Both firms maintained their ratings on Medtronic stock: Neutral at BTIG and Hold at Truist. Shares of MDT fell nearly 5% today, trading around $81.22 near mid-day. For comparison, MassDevice’s Medtech100 index was up about 1% on the day.