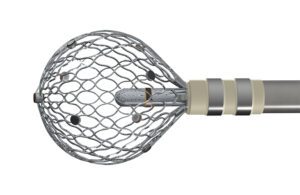

Affera’s Sphere-9 mapping and ablation catheter [Photo courtesy of Affera]

Affera started in 2014 with a simple goal that paid off when Medtronic (NYSE:MDT) bought the company for up to $1 billion this year.

Achieving that goal, however, took some unconventional and sometimes difficult design choices, Affera founder and CEO Doron Harlev said.

Newton, Massachusetts–based Affera’s system diagnoses, maps and treats heart arrhythmias with ablation. It’s a process that scars heart tissue to interrupt errant signals. Affera’s system uses both radiofrequency (RF) ablation — as well as the non-thermal pulsed-field ablation tech that has been generating buzz in medtech.

Complex arrhythmias like atrial fibrillation and ventricular tachycardia can require an electrophysiologist to perform more extensive ablation. But Harlev and his team at Affera thought a larger ablation tip could make these procedures easier. At the same time, the larger tip would offer better durability. As a result, there would be a reduced chance that ablated tissue would heal and allow the arrhythmia to return.

“The very origin of the company … was as simple as, ‘Let’s make a bigger tip,’” Harlev said. “The challenge is [that] we can’t just make it bigger because we’re not going to puncture a much bigger hole in the patient’s groin and advance that. So that means expandable … and that drove a lot of the innovation originally.”

In an interview with Medical Design & Outsourcing, Harlev and Rebecca Seidel, president of the Cardiac Ablation Solutions business in Medtronic’s Cardiovascular Portfolio, discussed how Affera’s devices work, the challenges to develop them and what’s next for the technology.

“We’ve been following Doron and his team for a very long time,” Seidel said. “They’re prolific inventors. And that’s what we were really most excited about, the fact that they’ve done all of this work. Although it may seem like it happens overnight when these deals happen, that’s not how it goes.”

What does Affera’s cardiac arrhythmia tech do?

Affera founder and CEO Doron Harlev [Photo courtesy of Affera]

Affera’s platform includes its Prism-1 system for high-density mapping and navigation. The platform combines Prism-1 with the minimally invasive Sphere-9 cardiac diagnostic and ablation catheter. FDA has not yet approved the technology for commercial use. However, Affera’s system has treated patients through an ongoing clinical trial under an FDA Investigational Device Exemption.

Affera’s lattice-tip Sphere-9 catheter expands after insertion into the heart and can deliver both radiofrequency and pulsed-field energy. The Sphere-9 catheter isn’t just a therapeutic catheter; it does double duty by collecting data for arrhythmia mapping.

“It’s unique in that it allows us to perform what’s called high-density mapping with one device, and it was designed at the same time as the rest of the system,” Harlev said. “The rest of the system includes the therapy delivery subsystems for radiofrequency and pulsed-field ablation, as well as the mapping. These were all designed at exactly the same time and came to be at the same time, feeding off each other, which is relatively unusual.”

That simultaneous design approach helped streamline and simplify the entire system. As a result, electrophysiologists could more effectively diagnose and treat cardiac arrhythmia.

“EPs are considered — I don’t want to offend the other kinds of physicians — but they’re kind of the rocket scientists, the nerds, the techies, the geeks,” Harlev said. “It’s a very interesting field of medicine where there’s a lot of complexity. It necessitates a lot of manual dexterity to move into position a catheter, a lot of mental abilities to analyze and understand these squiggles that we call electrograms.”

Affera’s cardiac ablation design challenges

Affera’s Sphere-9 mapping and ablation catheter [Photo courtesy of Affera]

The Sphere-9 catheter has a 9 mm compressible lattice nitinol tip with nine mini-electrodes (each with a temperature sensor) for energy delivery. Harlev said the choice of the spherical shape and the nickel-titanium alloy for the ablation tip was “provocative” but worked out.

“When you consider putting that into a heart and delivering energy through it, your first reaction might not be favorable,” he said. “When we decided to pursue that, we did it in a very staged manner. First, we did some simulations and thinking about the physics, then things on the bench to see if you’re seeing anything untoward, then there’s a variety of animal models you can use to gain confidence that this thing’s actually going to work, increasing the realism of how this device, for example, would interact with blood. Then eventually you go to patients, and even when you go to patients you can sometimes pursue indications that would be more forgiving and safe before you go to other indications.”

RELATED: Design challenges to overcome when developing cardiac ablation devices

The most challenging times were when the Affera team wasn’t sure if they were headed in the right direction and whether their results were due to a major design flaw or just needed a minor revision.

“When you’re charting new ground, going in a new direction, you don’t know when to continue to be stubborn and persistent and just get to a solution or to actually give up and say, ‘This is a dead end. Let’s take a different turn,’” Harlev said.

Affera initially considered more of a balloon-based design for the catheter tip, Harlev said, but abandoned that approach after more than a year of development to look into other solutions.

“Smelling burnt rubber after you’ve ablated is not pleasant,” Harlev said. … “The way the Sphere-9 looks today — it’s funny, but it was actually Plan B. Sometimes when you’re doing a device that’s a little bit more derivative, sometimes you don’t even understand how many questions have been answered for you.”

Why did Medtronic buy Affera?

The Affera system cart for radiofrequency and pulsed-field ablation [Photo courtesy of Affera]

Affera’s technology complements Medtronic’s existing atrial and ventricular arrhythmia disease management portfolio. The acquisition also gives Medtronic its first cardiac mapping and navigation platform.

“We’ve been super successful with the cryoballoon therapy, but that’s a pulmonary vein isolation tool and as a patient’s disease progresses, physicians want to do other things besides pulmonary veins. They want to treat different parts of the heart,” Seidel said. “When you get into that space, that’s when you need a mapping and navigation system to be able to tell you where you are and where you’ve ablated. We need that. We have our DiamondTemp catheter, a focal catheter and our PFA catheter, and even with some cryo, when they go to second procedures, they want to see where they’ve been. So it’s critically important for us to be able to expand our portfolio with mapping and navigation.”

The Sphere-9 catheter’s large footprint and dual abilities also stood out from the field, Seidel said.

“The Sphere-9 tool is a mapping catheter and a therapeutic catheter, which is differentiated from anything in the market. We don’t see that anywhere,” she said. “And we feel like that’s an exciting opportunity for physicians, so they don’t have to exchange the catheter or have a second catheter to do the mapping and the ablation.”

What’s next for Medtronic and Affera

Harlev and Seidel could not say when they hoped to win regulatory approval for Affera’s technology.

Medtronic’s PulseSelect pulsed-field ablation catheter [Image courtesy of Medtronic]

Affera’s multicenter trial of its Sphere-9 catheter for treating persistent atrial fibrillation is expected to be complete in November 2023. Medtronic expects results from a clinical trial of its own pulsed field ablation system, PulseSelect, in early 2023.

RELATED: What is pulsed-field ablation? Here’s what you need to know

Is Medtronic big enough for two PFA offerings?

“The physicians are going to tell us what they like best,” Seidel said. “And the clinical trials will tell us if they are efficacious and how the patients do. I think that’s where we’re all going to learn. … It’s so early, and I think there’s room for both.”

Harlev also weighed in. “Different patients need different tools and different physicians have different preferences. So that’s why we can have simultaneously something like the cryo Arctic Front be very successful while the J&J ThermoCool is very successful. … The Sphere-9 and the PulseSelect are just as different as those two are.”

Harlev and Seidel hope to advance the field of pulsed-field ablation by bringing engineers from Medtronic and Affera together to share what they’ve learned. The Affera team spent significant time dialing in the energy delivery. Also, they brought patients back for “remapping” a few months after ablation. Their goal was to evaluate how well the procedure worked.

“We certainly had our share of disappointments early on,” Harlev said. … “Unfortunately when it comes to PFA, in part because it’s so new and in part probably because of physiological reasons, what you learn from animals is not sufficient. You have to move forward in your development. One aspect is optimizing the dose. … Because this device is part of a mapping system, it can monitor a lot of parameters right before and during delivery and give feedback on how well you’ve likely done or maybe where you should be touching up.”

Can Medtronic help take Affera technology to the next level?

Bringing the two companies together makes it more likely that Affera’s technology will take off.

Rebecca Seidel is president of the Cardiac Ablation Solutions business in Medtronic’s Cardiovascular Portfolio. [Photo courtesy of Medtronic]

“They’ve been working on this technology for quite some time.” Seidel said, “and we have super high confidence that they’ve done all this iterative work and are making this technology super successful. … What we bring is a large team that can help scale the technology as well as a sales and commercial channel to bring it to market.”

Harlev compared the work ahead to Medtronic’s efforts to generate clinical data and prove the benefits of cryoablation. Medtronic bought Arctic Front cryoballoon catheter developer CryoCath in 2008.

“We all know how successful and helpful cryo has been — and it was an acquisition — but it took a tremendous amount of work,” Harlev said. “Medtronic is quite unique in its ability to bring big innovations and turn them mainstream.”