Astellas Pharma, the second largest Japanese pharma firm after Takeda, plans on scooping up the biopharma Iveric Bio for roughly $1.7 billion. Iveric focuses on discovering and developing novel therapies for retinal diseases, for approximately $1.7 billion.

Astellas Pharma, the second largest Japanese pharma firm after Takeda, plans on scooping up the biopharma Iveric Bio for roughly $1.7 billion. Iveric focuses on discovering and developing novel therapies for retinal diseases, for approximately $1.7 billion.

Astellas believes the acquisition of Iveric Bio will strengthen its standing in the ophthalmology market, by adding the latter’s pipeline products to its portfolio. The companies expect the deal to close in the third quarter of 2023.

Zimura, a potential geographic atrophy breakthrough

The centerpiece of the Astellas-Iveric Bio deal is the drug candidate, Zimura (avacincaptad pegol), which is now in phase 3 clinical trials for geographic atrophy. The condition trails age-related macular degeneration (AMD) as a leading cause of irreversible blindness among the elderly. Geographic atrophy is an advanced form of the disease. No therapies are now approved to treat the condition.

Zimura, inhibitor of complement factor C5, has shown its potential in reducing the progression of geographic atrophy. If approved, Zimura would address a significant unmet medical need.

A closer look at the transaction

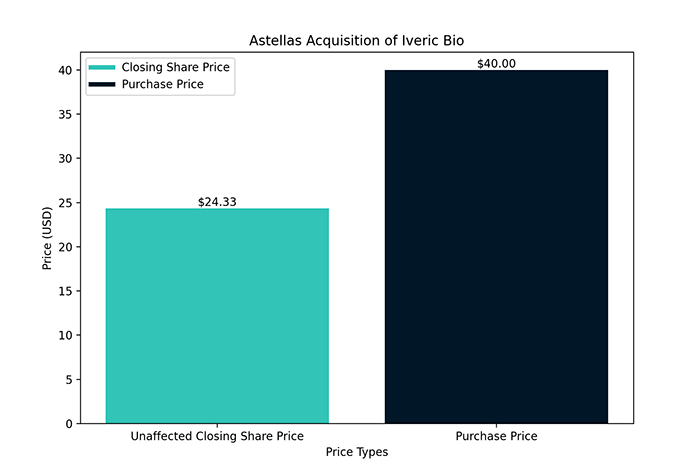

Astellas acquisition of Iveric Bio: Unaffected closing share price vs. purchase price

The bar graph on the right reflects financial figures related to Astellas’s purchase of Iveric Bio. The figures include the unaffected closing share price, purchase price and 30-day volume weighted average price (VWAP). The unaffected closing share price refers to the price of Iveric Bio’s shares at market close on the day prior to the acquisition announcement. Next, the purchase price reflects the premium amount Astellas has agreed to pay for each share of Iveric Bio.

Acquisition aligns with Astellas’ strategic focus on ophthalmology

The acquisition dovetails with Astellas Pharma’s strategic focus on expanding its presence in the ophthalmology market and ramping up its focus on retinal diseases in particular. The acquisition could Accelerate the commercialization of Zimura and other therapies for patients suffering from vision loss related to retinal diseases.

Moody’s sees the debt-funded transaction as credit positive for Astellas, given its impact on the company’s company’s drug pipeline and product portfolio. The deal will “likely materially increase Astellas’ leverage metrics,” wrote Dean Enjo, VP-Senior Analyst, Moody’s Japan. “The related increase in debt and leverage is a credit negative,” he added.

In its most recent credit opinion report on Astellas Pharma dated April 11, Moody’s gave Astellas an upper-medium grade credit rating of A3. The ratings firm cited the firm’s ability to generate free cash flow, given strong sales of its top-selling prostate cancer drug Xtandi (enzalutamide) and the successful launch of its antibody-drug conjugate Padcev (enfortumab vedotin).

Moody’s said in April that Moody’s credit rating was constrained by its “weakness in scale and product diversification compared to its peers.” Moody’s noted in April that Astellas “derives over half of its revenue from three drugs”, leaving it vulnerable to sales dips or potential setbacks in its late-stage pipeline, which could thwart the ability to counteract future patent expirations.

The Iveric Bio acquisition could diversify Astellas’ concentrated drug portfolio with the addition of ACP, a drug for geographic atrophy, if the drug is approved by the US Food and Drug Administration later this year.”

Moody’s noted, however, that the company overall had a stable outlook, reflecting Moody’s expectation that it would maintain a strong business position in the global pharma industry.

Astellas’ Acquisition of Iveric Bio example of broader pharma M&A uptick

Astellas proposed acquisition of Iveric Bio is consistent with a recent trend of large pharmaceutical companies acquiring smaller biotech firms to expand their R&D capabilities and pipelines. Examples of notable acquisitions in 2023 include Merck’s purchase of Prometheus Biosciences in April for $10.8 billion, Pfizer’s acquisition of Seagen for $43.0 billion. Astellas proposed acquisition of Iveric Bio is consistent with a recent trend of large pharmaceutical companies acquiring smaller biotech firms to expand their R&D capabilities and pipelines. Examples of notable acquisitions in 2023 include Merck’s purchase of Prometheus Biosciences in April for $10.8 billion, Pfizer’s acquisition of Seagen for $43.0 billion. Other notable deals include Sanofi’s purchase of Provention Bio in March for $2.9 billion and Astellas’ acquisition of Iveric Bio in April for $5.9 billion.

M&A deals in 2023, from January to early May.